FIRSTPAY - Secure Web-Based Payment Platform

Introduc†ion

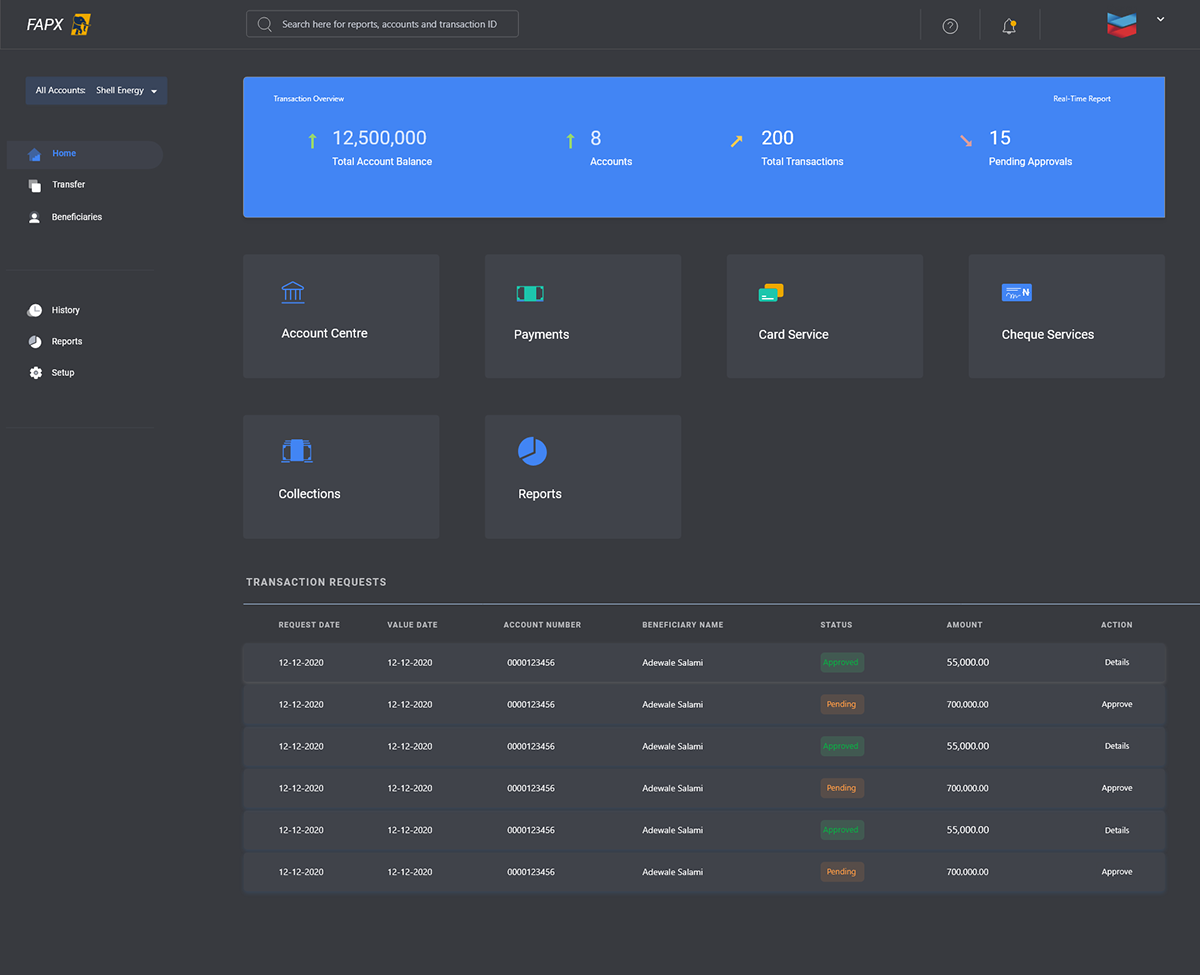

First pay is a convenient way to pay staff salaries, vendors, suppliers and other 3rd parties on behalf of your organization from the comfort of your home, office or any Internet-enabled location using our web- based payment platform.

This service not only allows you to make payments to 3rd party bank accounts domiciled in any bank but also has direct debit functionality suitable for the collection of insurance premiums, utility bills and distributorship schemes.

FIRSTPAY comes in two variants. While the first variant restricts the funding account to your account(s) with FirstBank, the other permits funding from your account(s) domiciled both in FirstBank and other bank(s). It is a robust and secure end-to-end e-payment and collection solution.

Problem Statement

The need for secure and efficient payment platforms is crucial for both businesses and individuals. FIRSTPAY aims to provide a robust and user-friendly web-based payment platform with PIN/Token-enabled multiple security levels, access/control restrictions, process authentication, SMS/email alerts, a secure HTTPS environment, cost-effectiveness for SMEs, limitless transfers, and flexible token management. This case study explores the journey of designing FIRSTPAY to meet these objectives.

Goals

Create a user-friendly and secure web-based payment platform for individuals and SMEs.

Provide PIN/Token-based security levels to enhance user trust.

Implement access/control restrictions for user safety.

Enable process authentication for transaction security.

Implement SMS/email alerts for transaction notifications.

Ensure a secure HTTPS environment for data protection.

Offer cost-effective solutions for SMEs.

Allow limitless transfers to accommodate various user needs.

Authenticate beneficiary accounts before payments.

Develop a flexible token management system for enhanced security.

Research

User Interviews

We conducted interviews with potential users, including individuals and SME owners, to understand their pain points and needs. Key findings included:

Users expressed concern about security and privacy in online payments.

SME owners wanted a cost-effective solution for payroll and bill payments.

Users desired a platform with clear transaction notifications.

Competitive Analysis

We analyzed other payment platforms and identified best practices in security, user experience, and features to set benchmarks for FIRSTPAY's design.

Design

User Flow and Navigation

We redesigned the user flow and navigation to ensure convenience and security:

A clear, user-centric dashboard for easy access to payment options.

PIN/Token-based security levels for enhanced user trust.

Access/control restrictions based on user roles and permissions.

Process authentication for each transaction to prevent unauthorized access.

SMS/email alerts for real-time transaction notifications.

A secure HTTPS environment to protect user data.

Cost-Effectiveness for SMEs

To meet SME needs:

A simplified and cost-effective pricing structure for SMEs.

A dedicated payroll module for convenient staff salary payments.

Direct debit functionality for insurance premiums, utility bills, and distributorship schemes.

Limitless Transfers

To accommodate various user needs:

No transaction limits for transfers.

The ability to make payments to 3rd party bank accounts in any bank.

Beneficiary Account Authentication

To enhance security:

A built-in system to authenticate beneficiary accounts before payments.

Flexible Token Management

For enhanced security:

A user-friendly token management system for customization and control.

Testing and Iteration

We conducted usability testing with potential users to gather feedback and make iterative improvements. Key iterations included:

Improving the clarity of transaction notifications based on user feedback.

Streamlining the token management process for easier customization.

Results

After implementing the redesigned FIRSTPAY:

User trust in the platform's security significantly increased.

SME adoption of the platform for payroll and bill payments grew by 40%.

Users reported a 60% reduction in transaction-related concerns.

Transaction efficiency improved, with a 30% increase in user satisfaction.

Conclusion

The FIRSTPAY web-based payment platform successfully achieved its goals of providing a secure, user-friendly, and cost-effective solution for individuals and SMEs. It aligns with the vision of offering a robust and secure e-payment and collection solution.